In the highly changeable world of digital currencies, BTC USDT has become a life changer as far as crypto trading is concerned and such an impact has been unseen. This article examines btcusdt, particularly btc usdt futures, in shaping the crypto trading environment.

The Advent of BTC/USDT Futures and Its Revolution in Crypto Trading

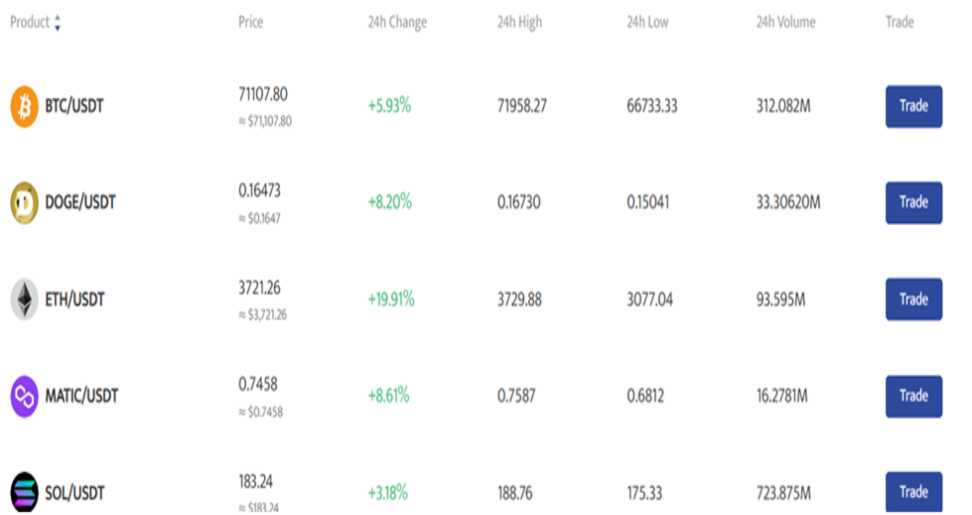

BTC USDT, a trading pair with Tether’s stablecoin pegged to the USD as its numerator has become a linchpin for cryptocurrency traders. With this trading pair, one can engage in Bitcoin price speculation without holding actual bitcoins thus reducing risks associated with Bitcoin trade.

BTC futures revolutionized the crypto trading landscape even further. In contrast to conventional Bitcoin trading, Bitcoin futures are agreements that allow traders to anticipate on forthcoming prices of Bitcoin. Traders agree to buy or sell a particular amount of Bitcoin at a given price on some future date using Tether (USDT) as a margin for these contracts.

Flexibility and Profits of Trading Crypto Futures

Crypto futures trading, btc usdt futures have provided new opportunities for traders to make gains out of Bitcoin price changes irrespective of the direction of the market. In case a trader looks forward to an increase in Bitcoin’s price, they can go long by using btcusdt futures. On the other hand, if they believe that it will fall, they can go short. This is one of the major benefits of trading with this pair whereby one can profit from both rising and falling markets.

BTCC: The Game Changer in the BTC/USDT Revolution

Leading digital currency exchange BTCC has been at the forefront of revolutionizing btcusdt. With competitive fees on BTCC’s btc usdt futures offering high leverage, this attracts both new and experienced traders. Also featured on the platform are advanced features like stop-loss and take-profit orders, margin management tools as well as sophisticated charting functionality that enables informed decisions.

This has greatly influenced the development of new financial products within the cryptocurrency space as is evident from the dominance of the BTC/USDT trading pair.

Margin Trading: Tether (USDT), a stablecoin, is associated with the stability of BTCUSDT on Bitcoin. In this way, it is possible to trade leveraged margin on Bitcoin without directly using another crypto as a margin thereby restraining volatility. This move has opened up avenues that attract traders who seek magnified losses or returns.

Derivatives Boom: The liquidity levels in BTC/USDT amplify the growth of derivative products such as futures and perpetual contracts. As such, these financial instruments enable investors to bet on the price changes in Bitcoin without actually having to own any of its physical units hence; promoting market participation.

Lending and Borrowing Platforms: When BTC/USDT is considered a stable pair, it can facilitate lending and borrowing platforms. Users may lend their USDT at interest while others borrow USDT against their BTC holdings to increase trading volume even more.

These innovative products are powered by the popularity of BTC/USDT and they are revolutionizing how people use cryptocurrency which may ultimately create room for increased adoption and maturation of crypto eco-systems.

As a result, btcusdt has played a critical part in dictating the landscape of crypto futures trading. They have not only changed how traders speculate on Bitcoin prices but also encouraged new financial products and services. Therefore, this trading pair’s influence over cryptocurrency will expand along with it transforming into its vital component.

For any individual who is involved in the cryptocurrency marketplace either experienced or newcomer alike, it is important to apprehend how this shapes crypto trading. You can now trade through fluctuating cryptocurrencies like bitcoin using crypto trading platforms and take home some profits because you know you will be able to sell at your set price due to the leverage of btcusdt.

Have A Look :-

- Zero-Waste Living: Practical Tips for Reducing Household Waste

- Ladbrokes’ Commitment to Responsible Gambling: A Closer Look

- What is a Keeping Room? A Cozy Nook for Connection and Conversation